- #CASHFLOW MANAGEMENT APPS FULL#

- #CASHFLOW MANAGEMENT APPS PROFESSIONAL#

- #CASHFLOW MANAGEMENT APPS FREE#

#CASHFLOW MANAGEMENT APPS FREE#

While it’s free to sign up, you may run into a handful of expenses along the way, such as a 0.15 percent fee for robo-investing. Top features include commission-free trades, robo-investing, crypto investing, and a cashback credit card. It provides access to both a credit card and high yield checking account, along with investing tools.

Unifimoney is more than a money management platform. Please visit the Unifimoney website for current terms. *Editorial Note: This offer is no longer available. Related: The Best Investment Apps Unifimoney You can also use YNAB to help you set financial goals and make the most of each dollar you earn. Like many other money management apps, YNAB offers bank syncing and support for mobile devices. You’re encouraged to place a premium on thinking ahead and determining where your money goes ahead of time, from investing to saving up for a vacation to paying the bills to buying groceries. The philosophy underlying YNAB is a job for every dollar. Cashback will be applied automatically when the final transaction posts, which may be up to a week after the qualifying purchase. Cashback deals on Empower Card purchases, including categories, merchants, and percentages, will vary and must be selected in the app. We generally post such deposits on the day they are received which may be up to 2 days earlier than the employer’s scheduled payment date. * Early access to paycheck deposit funds depends on the timing of the employer’s submission of deposits. Banking services provided by nbkc bank, Member FDIC.

#CASHFLOW MANAGEMENT APPS FULL#

Visit Empower or Learn more in our full Empower ReviewĮmpower is a financial technology company, not a bank.

You can think of it as a tool to help you get better control of your budget, while also continuing to move at least some money into emergency savings for future use. You can also earn up to 10% cashback* when you use the Empower Card to shop at select retailers, meaning you can save money on some purchases. Empower will deduct the amount it advances from your next paycheck to settle up. When you deposit your paycheck to Empower, you’ll get the ability to access your paycheck up to two days faster* and accept Cash Advances of up to $250.^ There are no interest charges or late fees for these Cash Advances. There are other ways that Empower can help you save money. Empower will provide a snapshot of your subscriptions and help you cancel any you no longer use. The main advantage to Empower is the fact that your investments are considered in the equation, giving you a holistic view of your total financial picture.īeyond budgeting, Empower will also look for savings in your spending patterns.

#CASHFLOW MANAGEMENT APPS PROFESSIONAL#

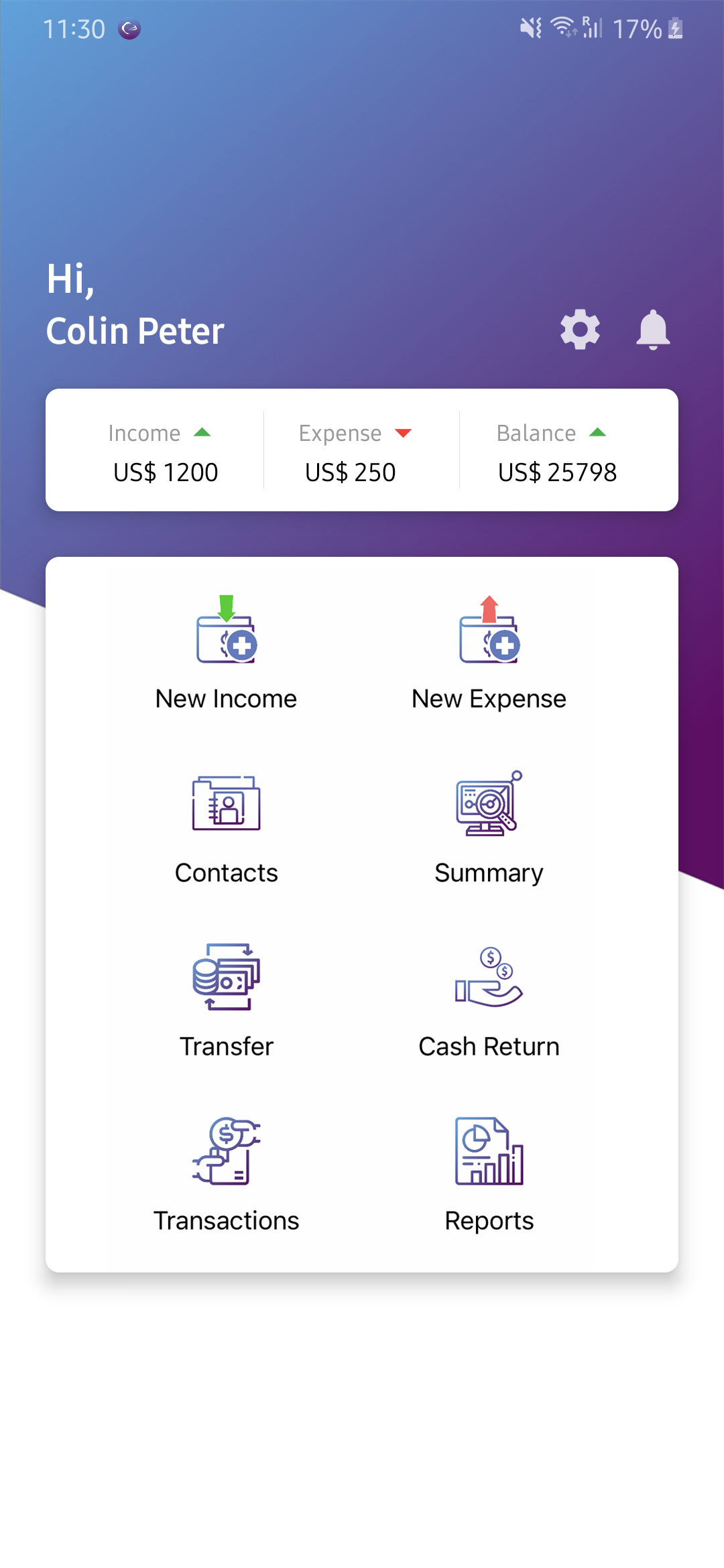

You can even get help from an investment professional in some cases.Įmpower’s budgeting functions arent quite as robust or intuitive as some of the other money management tools, but they get the job done. Graphs of your investments by asset class, investment account, or individual investment are easy to read, making it easy to track your investment performance and manage your portfolio. The interface is intuitive and the visuals are easy to see on desktop, laptop, tablet, or phone. Its lets you track your budget while including information about your investment accounts. Here are 13 of the best money management apps you should consider: EmpowerĮmpower is one of the best money management apps available. Many money management apps are viewable online, as well as on your mobile device, making it easy to take care of your finances no matter where you are. Plus, there are also apps that will help you make better financial decisions, based on the data gathered from your accounts.Īnd the best part? You can access your financial situation wherever you go.

Luckily, the market is saturated with money management apps designed to help you see your bank balance, track your spending, and analyze your habits. How much is coming in, when it hits your bank account, and where it’s going are all important aspects of financial success. Understanding your cash flow is a major part of successfully managing your finances. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

We may receive compensation from the providers of some products mentioned in this article.

0 kommentar(er)

0 kommentar(er)